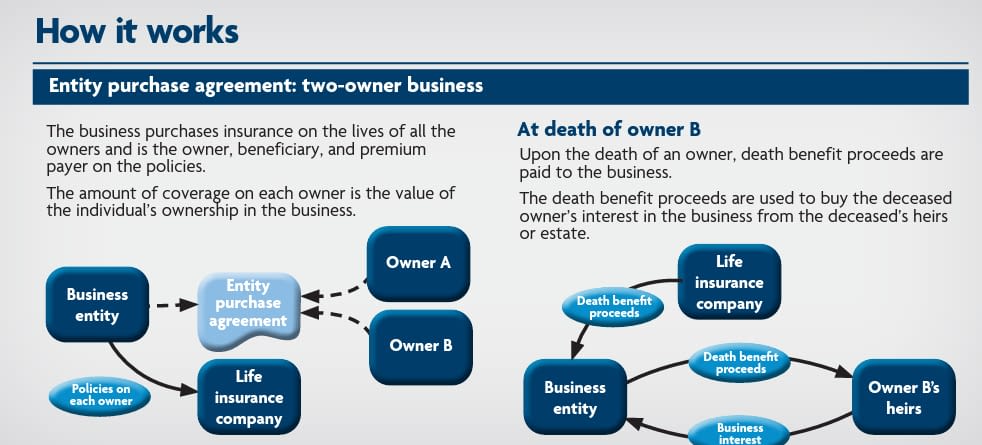

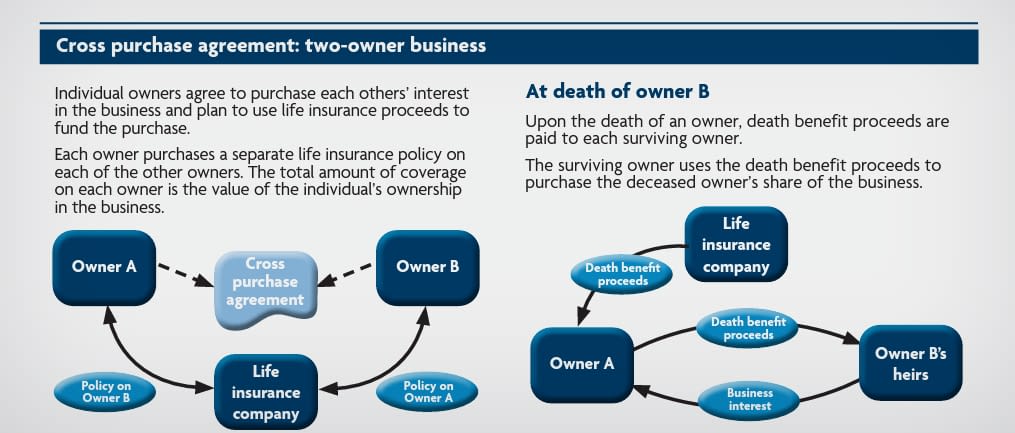

From modest family operations to multi-billion dollar corporations, the death of an owner can seriously cripple a business. We at Lowdermilk & Associates have partnered with Midland National to offer Buy-Sell agreements. These allow for a smoother transition in ownership to the surviving owners.

Heirs

Without a buy-sell agreement, the heirs of a deceased owner will inherit that owner’s shares of the company, yet they may not want to be a part of the business. A buy-sell agreement provides a buyer for their inherited business interest, freeing them from the burden of taking on a role as an owner. This also protects the business from shares being sold to someone outside the current ownership.

Surviving business owners

The surviving owners need to have funds available to buy shares from the heirs. Borrowing funds at expensive interest rates, liquidating business assets or using personal property as collateral to fund the purchase all have risk and negative impacts. A life insurance solution Life insurance can be a cost-efficient and relatively simple way to fund a buy-sell agreement. Funding through life insurance is potentially guaranteed and is also generally tax free.